A HIPAA covered entity is any organization that creates, receives, maintains, or transmits protected health information as part of delivering, paying for, or administering healthcare.

This definition sounds simple. In practice, it is one of the most misunderstood areas of HIPAA compliance, and that misunderstanding creates real risk.

At Mindcore Technologies, HIPAA assessments routinely uncover organizations assuming they are not covered entities, or underestimating the scope of their responsibility, until an audit or incident proves otherwise.

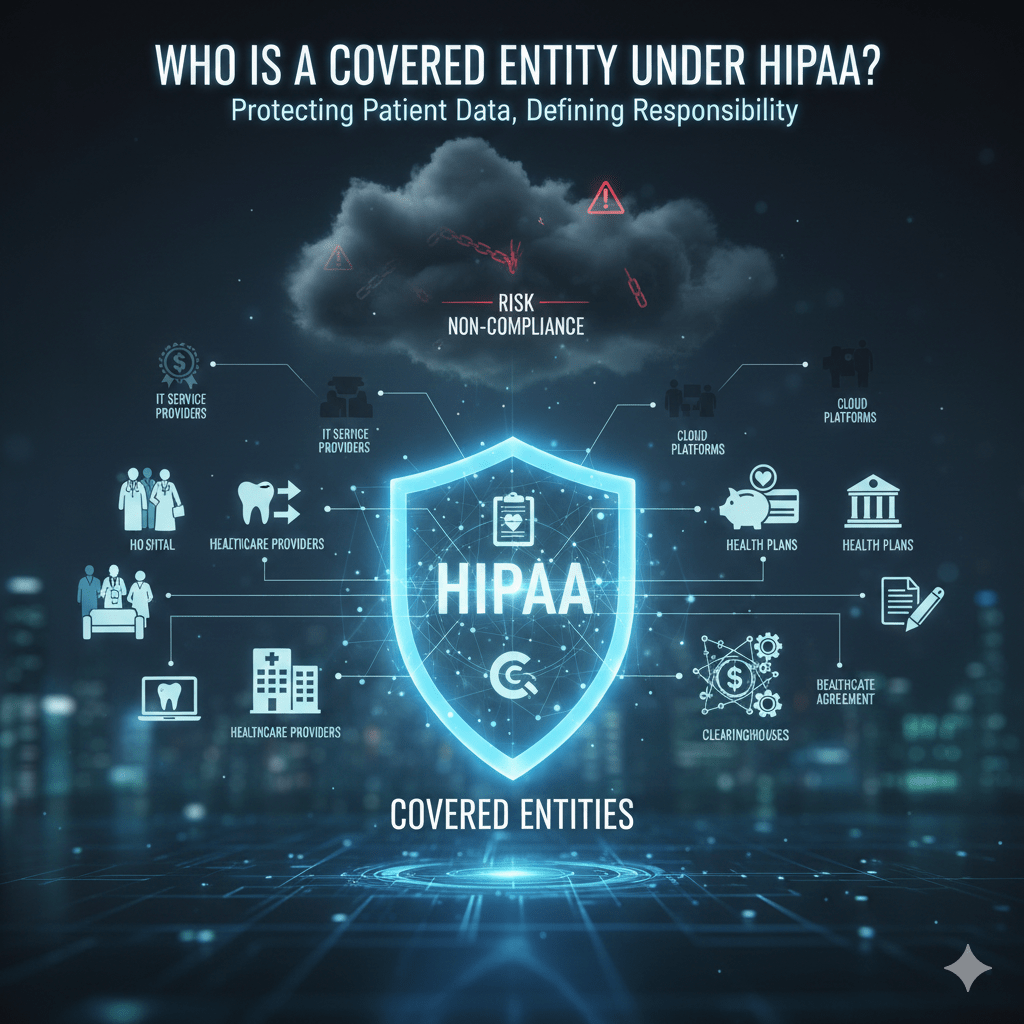

The Three Categories of HIPAA Covered Entities

HIPAA defines covered entities across three specific categories. If an organization fits into any one of these, HIPAA applies.

1. Healthcare Providers

Healthcare providers are covered entities when they transmit health information electronically in connection with standard transactions, such as billing or eligibility checks.

This includes:

- Hospitals and health systems

Acute care, specialty care, and integrated delivery networks handling PHI daily. - Physicians, clinics, and group practices

Primary care, specialty practices, and outpatient facilities. - Dentists, optometrists, and chiropractors

Providers often overlooked but fully subject to HIPAA. - Mental health and behavioral health providers

Including therapists, counselors, and treatment centers. - Telehealth and virtual care providers

Regardless of whether care is delivered in person or remotely.

Once a provider uses electronic systems for care or billing, HIPAA applies fully.

2. Health Plans

Health plans are covered entities because they pay for or manage the cost of medical care.

Examples include:

- Health insurance companies

Commercial insurers, HMOs, and PPOs. - Employer-sponsored health plans

Including self-funded plans administered internally or by third parties. - Government health programs

Medicare, Medicaid, and similar programs. - Prescription drug plans

Pharmacy benefit managers and related entities.

Health plans handle vast amounts of PHI and are subject to strict access and audit expectations.

3. Healthcare Clearinghouses

Healthcare clearinghouses are covered entities that process nonstandard health information into standardized formats, or vice versa.

These include:

- Billing services and claims processors

Organizations translating claims into standard formats. - Data translation and processing services

Entities acting as intermediaries between providers and payers. - Revenue cycle management platforms

When they perform clearinghouse functions.

Clearinghouses are often deeply embedded in healthcare workflows and frequently underestimated as HIPAA risk centers.

What Makes an Organization a Covered Entity

An organization becomes a covered entity based on function, not size or intent.

Key factors include:

- Handling PHI as part of healthcare operations

Not incidental or unrelated access. - Electronic transmission of health information

Especially for billing and administrative transactions. - Direct role in care delivery, payment, or administration

HIPAA applies when PHI is core to operations.

Being small, outsourced, or cloud-based does not change coverage.

Covered Entities vs Business Associates

A critical distinction:

- Covered entities deliver, pay for, or administer healthcare.

- Business associates support those activities and access PHI on behalf of covered entities.

Examples of business associates include:

- IT service providers

- Cloud hosting platforms

- Billing vendors

- Analytics and transcription services

While business associates are not covered entities, they are still legally obligated under HIPAA through Business Associate Agreements.

Covered entities remain responsible for how PHI is accessed and protected across both groups.

Why Covered Entity Status Matters

Covered entities carry direct responsibility for:

- Protecting PHI

Ensuring confidentiality, integrity, and availability. - Enforcing minimum necessary access

Users see only what their role requires. - Maintaining auditability

Access and usage must be traceable. - Reporting breaches

Covered entities are accountable even when vendors are involved.

Misclassifying status leads to compliance gaps that surface during audits or incidents.

Common Covered Entity Mistakes We See

Real-world issues include:

- Assuming vendors carry all HIPAA responsibility

- Allowing excessive access to PHI internally

- Relying on VPNs and flat access models

- Treating compliance as documentation instead of architecture

- Lacking clear visibility into PHI usage

These failures usually occur during normal operations, not attacks.

How Architecture Impacts Covered Entity Compliance

Covered entities meet HIPAA expectations when:

- Access is identity-based, not network-based

- Permissions reflect job function and purpose

- Sessions are limited and auditable

- PHI remains inside controlled environments

They struggle when access is broad, persistent, and difficult to monitor.

How Mindcore Technologies Helps Covered Entities Reduce Risk

Mindcore supports HIPAA covered entities by:

- Assessing real-world PHI access paths

Identifying overexposure and misuse risk. - Reducing access sprawl through identity-driven controls

Enforcing least privilege consistently. - Containing PHI with secure workspace architectures

Preventing unnecessary endpoint exposure. - Improving audit readiness and visibility

Making compliance provable, not assumed.

The focus is reducing risk structurally, not administratively.

A Simple Covered Entity Reality Check

You are operating at higher HIPAA risk if:

- Users can access PHI beyond their role

- Vendors have broad or persistent access

- VPNs are required for PHI systems

- Audit evidence is manually reconstructed

- PHI reaches unmanaged endpoints

These conditions undermine HIPAA’s intent, even without a breach.

Final Takeaway

A HIPAA covered entity is defined by what it does with patient data, not how large it is or what technology it uses.

Organizations that clearly understand their covered entity responsibilities design access and data protection intentionally. Those that do not often learn their status during audits, investigations, or breaches, when correction is far more costly.